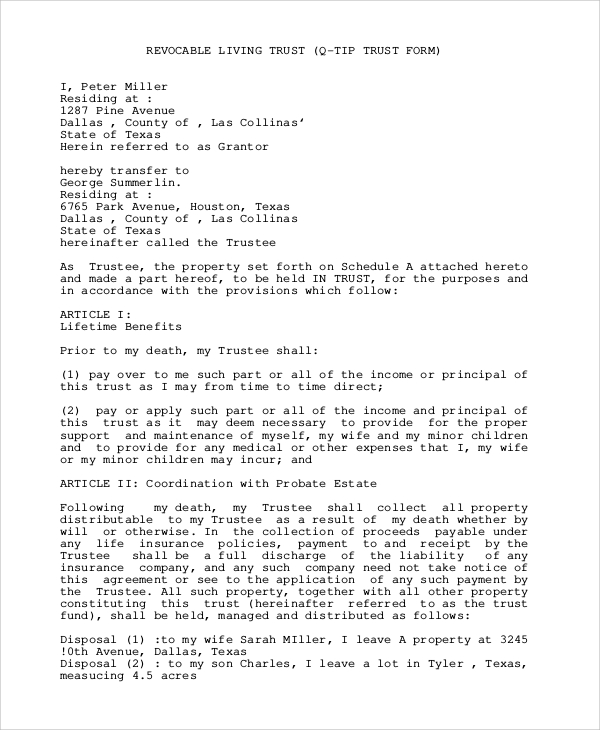

A trust provides flexibility because the grantor can include certain parameters such as age requirements or purpose requirements governing the dissemination of the assets.

Living trust forms texas.

Unlike a will a trust does not go through the probate process with the court.

Texas does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid texas s complex probate process.

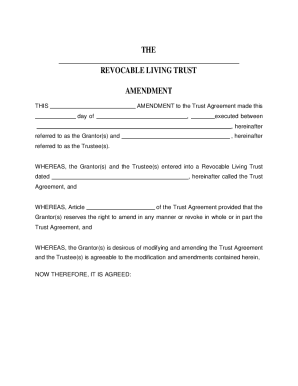

This form is for amending a living trust.

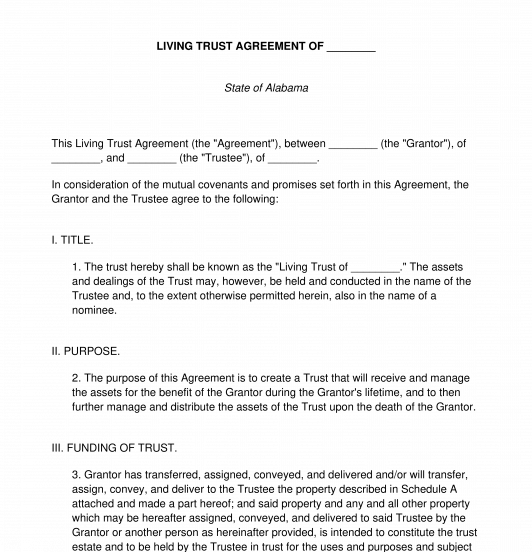

A trust is an entity which owns assets for the benefit of a third person beneficiary.

Probate is a court process that reviews verifies and enforces a will.

What is a trust.

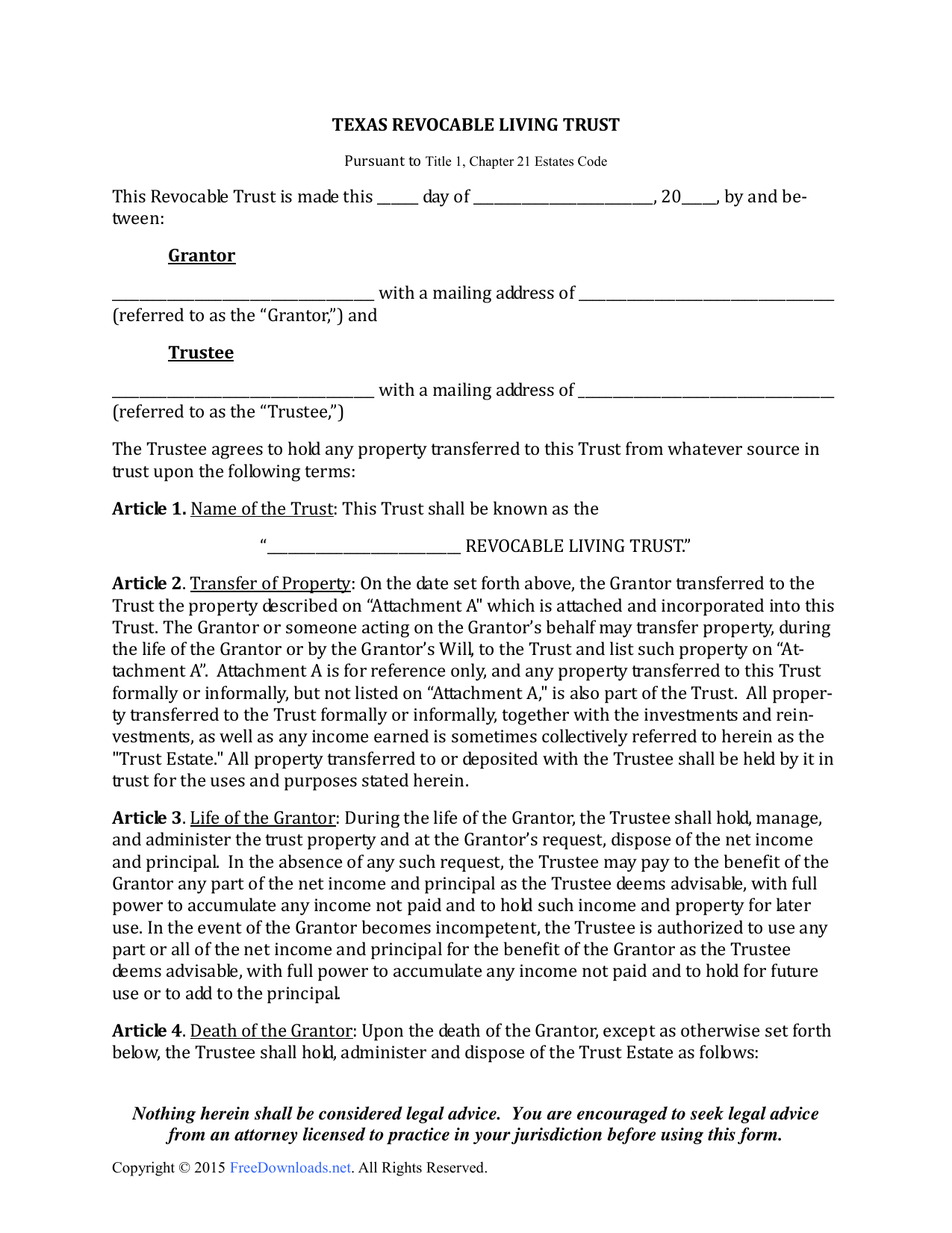

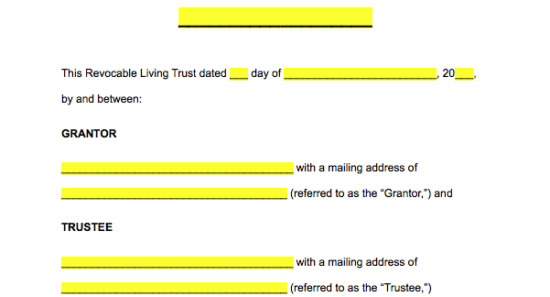

The grantor person who creates the trust names a trustee to oversee the management of the trust and beneficiaries to inherit or benefit from the assets within the trust.

This can take many months and since texas has not enacted the uniform probate code the process is complex.

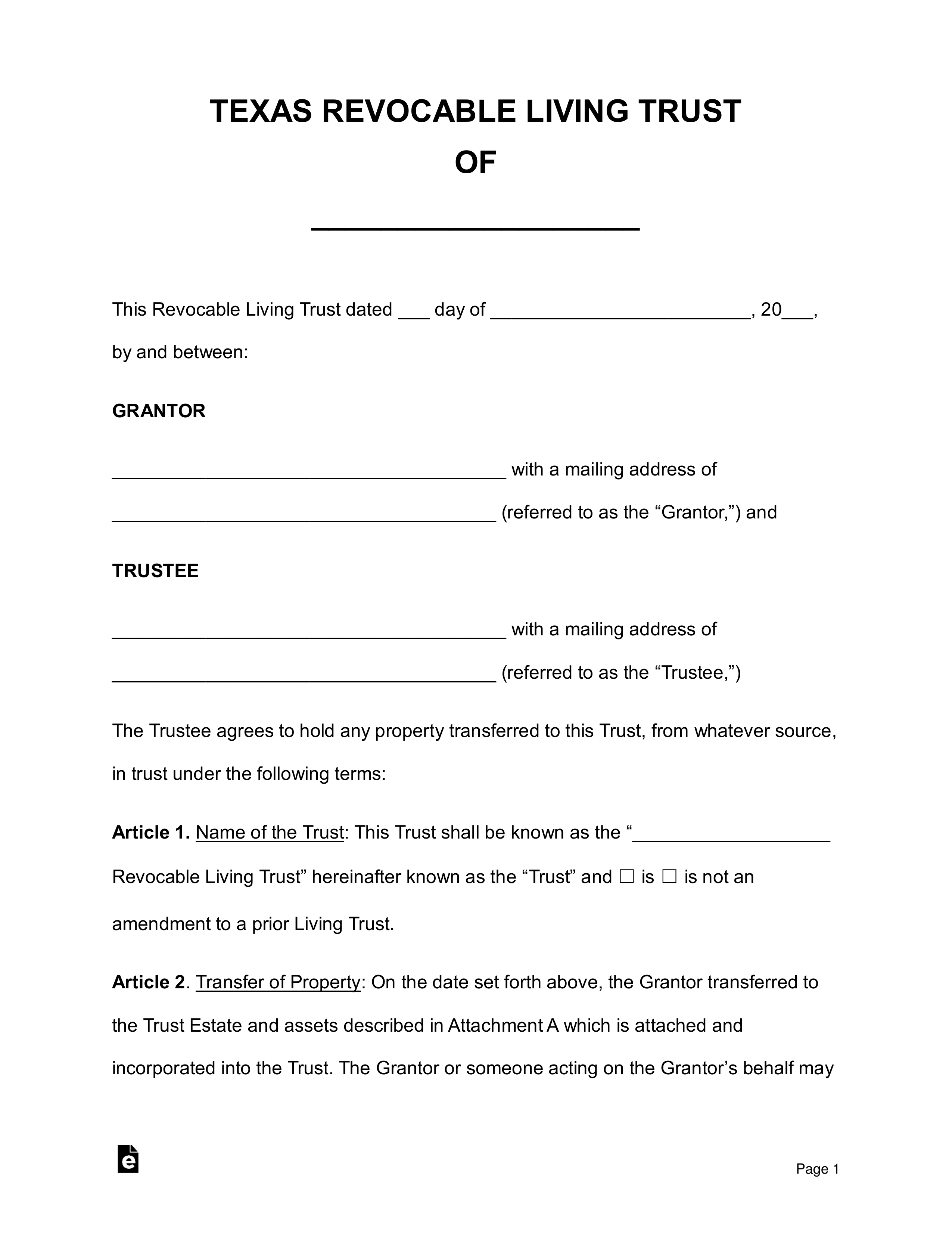

The texas living trust is an entity into which a person transfers their assets in order to maintain control of them during their lifetime and in the event that they become mentally incapacitated.

During the process of creating a living trust the grantor will transfer ownership of their property and assets into the trust.

A living trust is a trust established during a person s lifetime in which a person s assets and property are placed within the trust usually for the purpose of estate planning.

Texas has a simplified probate process for small estates under 75 000.

A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation.

The grantor maintains ownership over their assets and they can make alterations to the document or choose to revoke the trust at any point in their lifetime.

A revocable living trust is created by an individual the grantor for the purpose of holding their assets and property and in order to dictate how said assets and property will be distributed upon the grantor s death.

The texas revocable living trust is more commonly employed than an irrevocable living trust as a tool for managing a person s estate the reason being that a revocable living trust can be altered or revoked by the grantor at any time as their circumstances may change.

A living trust texas is beneficial because trust assets do not go through probate.

This form permits the trustor to.

Download a texas living trust form which provides a way for an individual to set aside certain property and assets into a separate entity for the benefit of the grantor s the person who creates the trust loved ones.

This guide will take you through the process of creating a living trust in texas giving you all of the information you ll need to make setting up a living trust as painless as possible.